Instalment gearing case study

Instalment gearing case study

Instalment gearing combines two investment strategies: borrowing to invest, and regular investing. By implementing a regular savings and investment plan you can progressively build an investment portfolio.

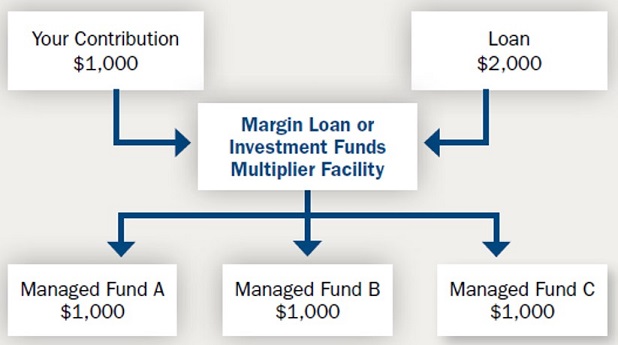

Initial investment

In this scenario, your initial contribution is $1,000 with a loan of $2,000 - making a total investment of $3,000. You decide to invest equally in three different managed funds.

Regular savings

Each month you elect to contribute $250 savings and borrow $350 - investing a total of $600. Each month your investment increases.

| Month | Loan | Total invested |

| Start | $2,000 | $3,000 |

| 1 | $2,350 | $3,600 |

| 2 | $2,700 | $4,300 |

| 3 | $3,050 | $4,800 |

Buying through the ups and downs

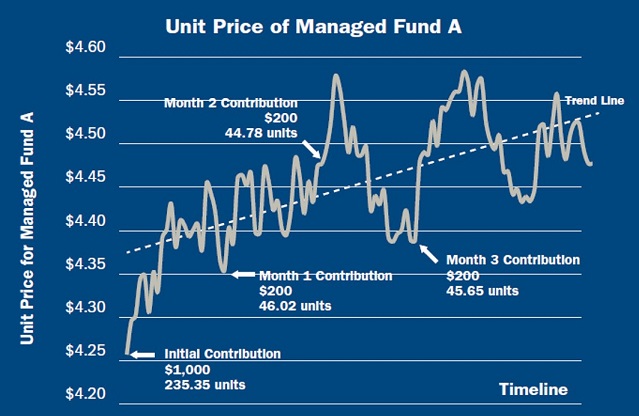

As you are investing on a monthly basis you purchase units in the selected managed fund at different times. The graph below illustrates the different unit prices and number of units purchased over three months for Managed Fund A.

In this example, you invested $1,600 in Managed Fund A at an average purchase price of $4.30. This investment is now worth $1,658. If you had held off investing until you had saved the $1,600, the same portfolio would have cost you $4.46 per unit.

| Month | Initial investment | 1 | 2 | 3 |

| Number of units issued in Managed Fund A @ Price | 235.35 @ $4,249 | 46.02 @ $4.346 | 44.78 @ $4.466 | 46.65 @ $4.381 |

This example highlights that even though it is difficult to pick the lowest price to enter an investment, with a regular investment plan you may be able to buy at a lower average price if the overall price is trending upward.

Things you should know

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses. Issued by Leveraged Equities Limited (ABN 26 051 629 282 AFSL 360118) as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879). Information is general advice only and does not take into account your personal objectives, financial situation or needs. The views of the author may not represent the views of the broader Bendigo and Adelaide Bank Group of companies (“the Group”). This information must not be relied upon as a substitute for financial planning, legal, tax or other professional advice. You should consider whether or not the product is appropriate for you, read the relevant PDS and product guide available at www.leveraged.com.au, and consider seeking professional investment advice. Not suitable for a self-managed superannuation fund.

Examples are for illustration only and are not intended as recommendations and may not reflect actual outcomes. Past performance is not an indication of future performance. The information provided in this document has not been verified and may be subject to change. It is given in good faith and has been derived from sources believed to be accurate. Accordingly no representation or warranty, express or implied is made as to the fairness, accuracy, completeness or correction of the information and opinions contained in this article. To the maximum extent permitted by law, no entity in the Group, its agents or officers shall be liable for any loss or damage arising from the reliance upon, or use of the information contained in this article.