How does gearing stack up?

How does gearing stack up?

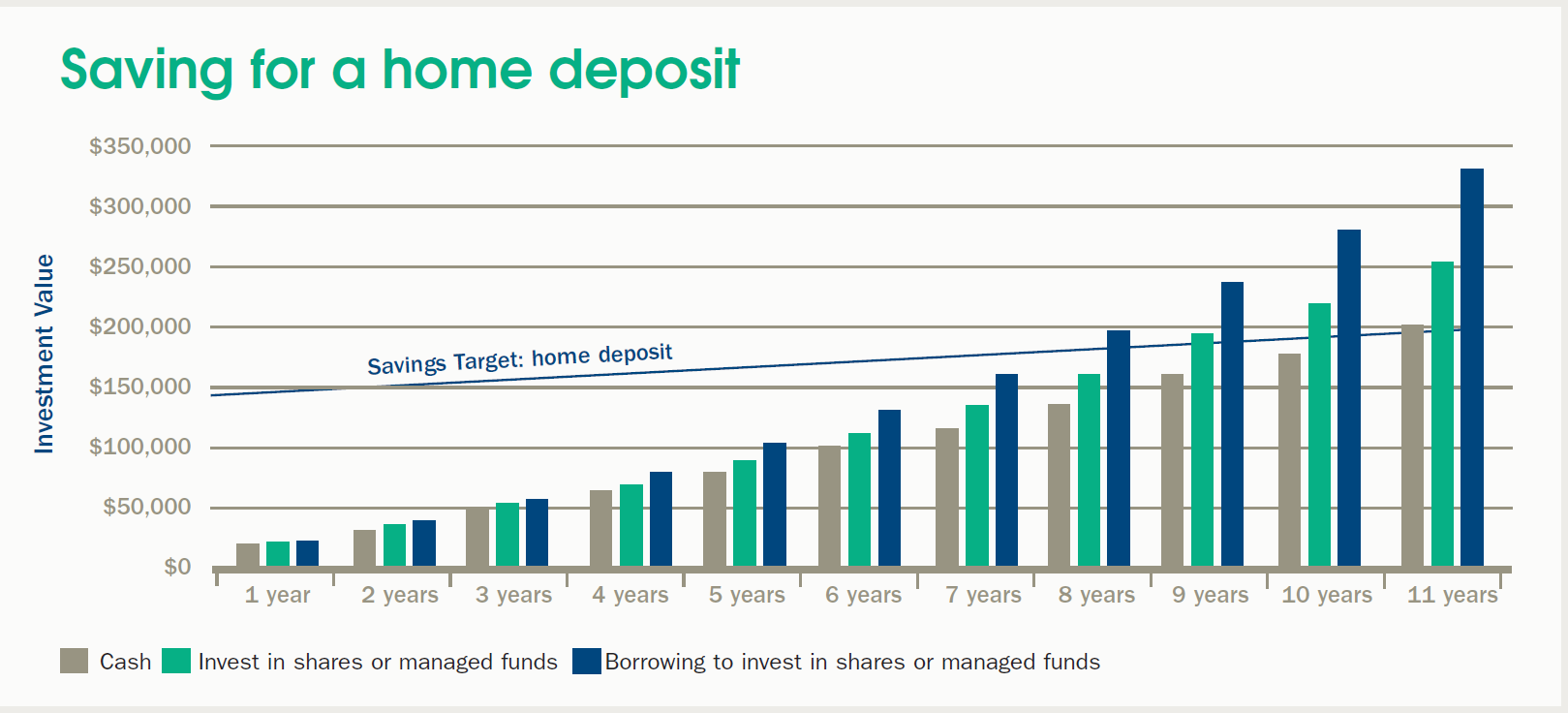

Using historical data and our brand-new savings simulator, we put three strategies to the test.

Ever wondered which savings and investment strategy is a proven performer?

The potential return on a term deposit is typically offset by inflation, but isn’t the share market too unpredictable? Using historical data and our brand-new savings simulator, we put three savings strategies to the test. The results demonstrate that, in order to get ahead, we need to make our money work harder.

Example: raising $70k in six years

Let’s say you’re aiming to raise $70,000 for a specific goal - maybe it’s a house deposit or your child’s education. With an $8,000 initial outlay and a $500 monthly contribution, we can follow the savings growth across:

- Cash

- Shares and managed funds

- Borrowing to invest

As the graph demonstrates, borrowing to invest is the only method out of the three options considered above which may achieve the savings goal of $70,000 by six years.

Further explanation

The Savings Simulator assumes a yield of 2.35% on cash, such as a term deposit. Over the past decade, the share market has delivered returns of 11.32% p.a., made up of 5.92% p.a. of capital growth and dividend income of 5.4% p.a. A margin loan can magnify these returns, when used sensibly and accepting that there is risk and investments will fluctuate.

Case study

Meet Sarah, 27, saving for her first house deposit

The median house price across Australia is now around $700,000 (REIA December Quarter 2015 figures), which means the standard 20% deposit required is a daunting $140,000.

Sarah is a 27-year-old lawyer, earning $85,000. Even with her reasonably high income and strong earning potential, raising a six-figure sum is no mean feat. She has $10,000 saved and can save an additional $1,000 per month.

Sarah could put 100% of her savings in a term deposit, which we’ll assume earns a constant 2.51% p.a. This strategy will take her 11 years to generate her deposit, which by then

– considering moderate inflation (3% p.a.) – will be around $194,000.

Investing in growth assets, like shares, make sense for Sarah

Sarah keeps up with the news and is aware of the share market’s ability to generate a strong return through the combination of capital growth and dividends.

She knows that the share market over the last ten years has returned 11.32% p.a., comprising 5.92% p.a. of capital growth and dividend income of 5.4% p.a. She decides to invest all of her savings in shares.

Sarah’s earnings expectations from her shares hold up, and she reaches her goal of saving for her deposit in approximately nine years (after allowing for expected capital gains tax). That’s a significant improvement on 11 years.

How can a gearing strategy into growth investments help Sarah?

Using her initial savings of $10,000, Sarah borrows an additional $10,000 to buy a $20,000 diversified portfolio of shares and managed funds. Each month, Sarah invests an additional $2,000 – $1,000 of her own savings, plus $1,000 of borrowed funds.

Her $10,000 loan costs her 5.99% a year, constant. Sarah may be able to claim this interest cost as a tax deduction and should be able to claim the franking credits on the dividends she receives each year, which are 57% franked.

Sarah understands that gearing involves risk; investments can go up and down. However, gearing at 50% is considered a moderate risk. Plus, Sarah feels that being in a relatively well-paid job, and given her age and ability to monitor her investments, she can afford to take on more risk.

Sarah regularly monitors her investments but knows not to over-react to short-term market fluctuations. Her portfolio continues to perform as expected, and she doesn’t sell any investments until she has achieved her goal.

Even after paying capital gains tax, this strategy accelerates Sarah’s progress and she can achieve her house deposit goal in eight years, rather than 11. Which means Sarah can be in her home three years sooner!

Things you should know

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses. Issued by Leveraged Equities Limited (ABN 26 051 629 282 AFSL 360118) as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879). Information is general advice only and does not take into account your personal objectives, financial situation or needs. The views of the author may not represent the views of the broader Bendigo and Adelaide Bank Group of companies (“the Group”). This information must not be relied upon as a substitute for financial planning, legal, tax or other professional advice. You should consider whether or not the product is appropriate for you, read the relevant PDS and product guide available at www.leveraged.com.au, and consider seeking professional investment advice. Not suitable for a self-managed superannuation fund.

Examples are for illustration only and are not intended as recommendations and may not reflect actual outcomes. Past performance is not an indication of future performance. The information provided in this document has not been verified and may be subject to change. It is given in good faith and has been derived from sources believed to be accurate. Accordingly no representation or warranty, express or implied is made as to the fairness, accuracy, completeness or correction of the information and opinions contained in this article. To the maximum extent permitted by law, no entity in the Group, its agents or officers shall be liable for any loss or damage arising from the reliance upon, or use of the information contained in this article.