Eliminate house 'FOMO'

Eliminate house 'FOMO'

Many young Australians are suffering from house ‘FOMO’. This buzzword – meaning ‘fear of missing out’ – is flippant in its origins; however, FOMO accurately describes the state of housing affordability amongst gen Y, and the condition is spreading. It’s time Australia starts thinking seriously about alternative strategies for our youth to achieve that prized first-home deposit.

For many young would-be home-owners, it’s not the house price rises that are worrying – it’s the deposits.

To get off the rental roundabout and into their own home, the first step for a home-buyer in most cases is to come up with a deposit of 20% of the amount they want to borrow. If they want to borrow with a deposit of less than 20%, the bank may charge them for the lender’s mortgage insurance (LMI) premium.

Six-figure sums

With the median house price across Australia sitting close to $700,000 (REIA December Quarter 2015 figures), home-buyers are looking at a deposit of at least $140,000 in some cases. That is what many of their parents’ generation would have paid for the house itself. As such, many young people are reasoning that how they save for their initial deposit also has to be different to what their parents did.

This is where a margin loan can enter the picture, as a way of using gearing to accelerate house deposit savings, in a tax-effective manner.

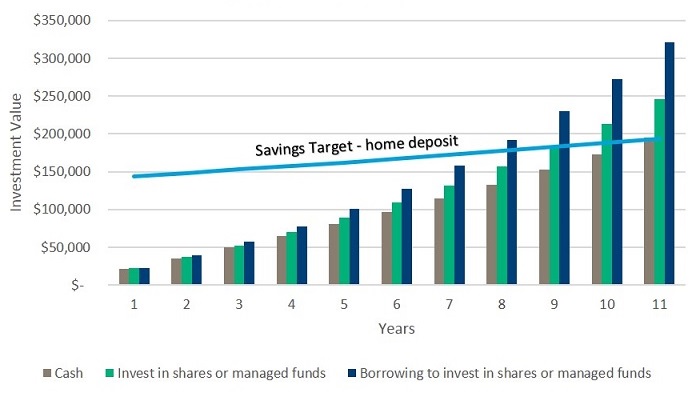

The goal – the home loan deposit – up to $140,000 today. Let’s assume it rises by 3% a year: this is at the higher end of the Reserve Bank of Australia’s (RBA) targeted inflation range, but a moderate rise compared to recent home price increases. Housing costs do not always rise, and are subject to falls in value like with any investment but for the purposes of this example we will assume they rise 3% per year.

Meet Sarah, 27, saving for her first deposit

Assume the borrower, Sarah, who is a 27-year-old lawyer earning $85,000 per annum, starts with $10000 savings, but can save $1000 per month.

Sarah can put 100% of her savings in a term deposit, which we’ll assume earns a constant 2.51% a year. In that case, it will take her eleven years to reach her goal of generating her deposit, which by year eleven will be about $194,000.

Shares stack up for Sarah

Sarah keeps up with the news and so is well aware of the share market’s ability to generate a strong return through the combination of capital growth and dividends. Sarah is on a marginal tax rate of 39%, including the Medicare levy. She knows that the share market over the last 10 years has returned 11.32% a year, made up of 5.92% a year of capital growth and dividend income of 5.4% a year. She decides to invest all of her savings in shares.

Sarah’s earnings expectations from her shares hold up, and she reaches her goal of saving for her deposit in approximately 9 years (after allowing for expected capital gains tax). That’s a significant improvement on eleven years.

How can a margin loan help?

However, Sarah investigates a margin loan. Using her initial savings of $10,000, she decides to borrow 50% of an investment in a diversified portfolio of quality shares and managed funds. Each month Sarah invests an additional $2000 made up of $1000 of her own savings plus $1000 of borrowed funds. Sarah understands that gearing involves risk; investments can go up and down. But Sarah feels that being in a relatively well-paid job, and given her age and ability to monitor her investments, she can afford to take on more risk. She buys a share portfolio of $20,000. Her $10,000 loan costs her 5.99% a year, constant. Sarah may be able to claim this interest cost as a tax deduction.

Sarah should be able to claim the franking credits on the dividends she receives each year, which are 57% franked.

Sarah regularly monitors her investments but knows not to over-react to short-term market fluctuations. Her portfolio continues to perform as expected, and she doesn’t sell any investments until she has achieved her goal.

Even after paying capital gains tax, this strategy gets Sarah to her goal in approximately eight years.

How it stacks up

Further savings

Thinking about it a different way, by reaching her goal three years earlier than saving with a term deposit, Sarah actually needs about $16,500 less than she would have needed otherwise, because she has removed a year’s worth of house price inflation from the equation. Getting into her own home a year earlier could be a nice head start for Sarah.

In the event Sarah decides not to buy a house after eight years and continues to save for the original 11 years, she can expect to have net savings of close to $321,000. This potentially gives her more financial freedom such as the flexibility to have a smaller home loan.

Sarah has also developed a great savings habit that will help her reach her goals, such as repaying her home loan and saving for retirement.

Things you should know

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses. Issued by Leveraged Equities Limited (ABN 26 051 629 282 AFSL 360118) as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879). Information is general advice only and does not take into account your personal objectives, financial situation or needs. The views of the author may not represent the views of the broader Bendigo and Adelaide Bank Group of companies (“the Group”). This information must not be relied upon as a substitute for financial planning, legal, tax or other professional advice. You should consider whether or not the product is appropriate for you, read the relevant PDS and product guide available at www.leveraged.com.au, and consider seeking professional investment advice. Not suitable for a self-managed superannuation fund.

Examples are for illustration only and are not intended as recommendations and may not reflect actual outcomes. Past performance is not an indication of future performance. The information provided in this document has not been verified and may be subject to change. It is given in good faith and has been derived from sources believed to be accurate. Accordingly no representation or warranty, express or implied is made as to the fairness, accuracy, completeness or correction of the information and opinions contained in this article. To the maximum extent permitted by law, no entity in the Group, its agents or officers shall be liable for any loss or damage arising from the reliance upon, or use of the information contained in this article.