Education savings plan

Education savings plan

Along with nurturing and protecting children, a good education is a fundamental responsibility for all parents. Education costs vary greatly between states, districts, level and type of school. However, one consistent challenge is the ever-rising costs of education. On average, inflation in education costs is about 2.50% above general inflation. If a strategy is too conservative or too optimistic, the risk of failing to reach each rung of the education expenses ladder can be significant.

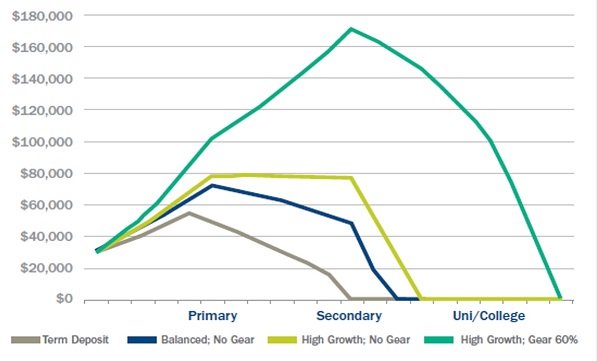

Strategy comparison: potential outcome

In this example, investing in a Term Deposit is the most conservative strategy, but may only cover a child’s primary school costs depending on the level of savings. Similarly, a balanced portfolio may fail to cover the full education expenses ladder. Even allocating modest savings to a high growth portfolio may not be sufficient; this strategy may only cover costs half way through secondary school.

For some parents, borrowing to invest may be a suitable strategy for reaching each rung of the education expenses ladder. Borrowing to invest is not without risks, but these risks should be weighed against the risks of falling short of the goal.

Information correct as at 25 May 2016.

Strategies and outcomes

Assumptions of the example

| Primary school | $10,000 p.a. starting at age 5 for 6 years |

| Secondary school | $25,000 p.a. starting at age 11 for 6 years |

| University/college | $30,000 p.a. starting at age 17 for 3 years |

| Education costs inflation | 3.50% p.a. constant |

| Starting capital | $30,000 p.a. |

| Regular savings | $5,200 p.a. Increasing by general Consumer Price Index each year |

| Term Deposit interest rate | 3.00% p.a. constant |

| Equities capital growth | 7.50% p.a. constant |

| Dividends (90% franked) | 2.00% p.a. constant |

| Equity portfolio annual turnover | 25% at discounted capital gains tax |

| Borrowing costs | 6.00% p.a. constant |

| Gearing ratio | 60% |

| General inflation (Consumer Price Index or CPI) | 2.00% p.a. constant |

| Marginal tax rate (including Medicare Levy) | 39% constant |

- Regular savings start in the year a child is born

- Balanced Portfolio returns based on 50% allocation to term deposit and 50% to equities

- High Growth portfolio returns based on 100% allocation to equities

- Amount borrowed adjusted each year to maintain gearing ratio but capped so that borrowing costs are less than expected dividends plus regular savings

- Investments are held on capital account. The investor is eligible to claim franking credits and interest as a deduction for income tax purposes

- Annual school fees withdrawn each year from investment capital

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses. Issued by Leveraged Equities Limited (ABN 26 051 629 282 AFSL 360118) as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879). Information is general advice only and does not take into account your personal objectives, financial situation or needs. The views of the author may not represent the views of the broader Bendigo and Adelaide Bank Group of companies (“the Group”). This information must not be relied upon as a substitute for financial planning, legal, tax or other professional advice. You should consider whether or not the product is appropriate for you, read the relevant PDS and product guide available at www.leveraged.com.au, and consider seeking professional investment advice. Not suitable for a self-managed superannuation fund.

Examples are for illustration only and are not intended as recommendations and may not reflect actual outcomes. Past performance is not an indication of future performance. The information provided in this document has not been verified and may be subject to change. It is given in good faith and has been derived from sources believed to be accurate. Accordingly no representation or warranty, express or implied is made as to the fairness, accuracy, completeness or correction of the information and opinions contained in this article. To the maximum extent permitted by law, no entity in the Group, its agents or officers shall be liable for any loss or damage arising from the reliance upon, or use of the information contained in this article.